Blog

Corporate tax in the UAE: How is it calculated?

global

During the past few years, the UAE has experienced significant tax changes aimed at bringing its tax system in line with international best practices and diversifying its state revenue. As a result, when it comes to the calculation of the tax payable, not all businesses experience the same thing. Many business entities in the UAE still stumble in calculating corporate tax. But in order to prepare for the UAE corporate tax regime, it is crucial to learn how to calculate the amount of corporate tax. To ensure efficiency and accuracy in the calculation, it is advisable to seek professional help from top accounting firms in the UAE. Tax consultants in the UAE can provide any guidance your business may need on all prospects of corporate tax.

UAE corporate tax in a bird’s eye view

Corporate tax is a form of direct tax imposed on corporations and other business entities' profits or net income. There are also jurisdictions in which Corporate Tax is referred to as "Corporate Income Tax (CIT)" or "Business Profits Tax".

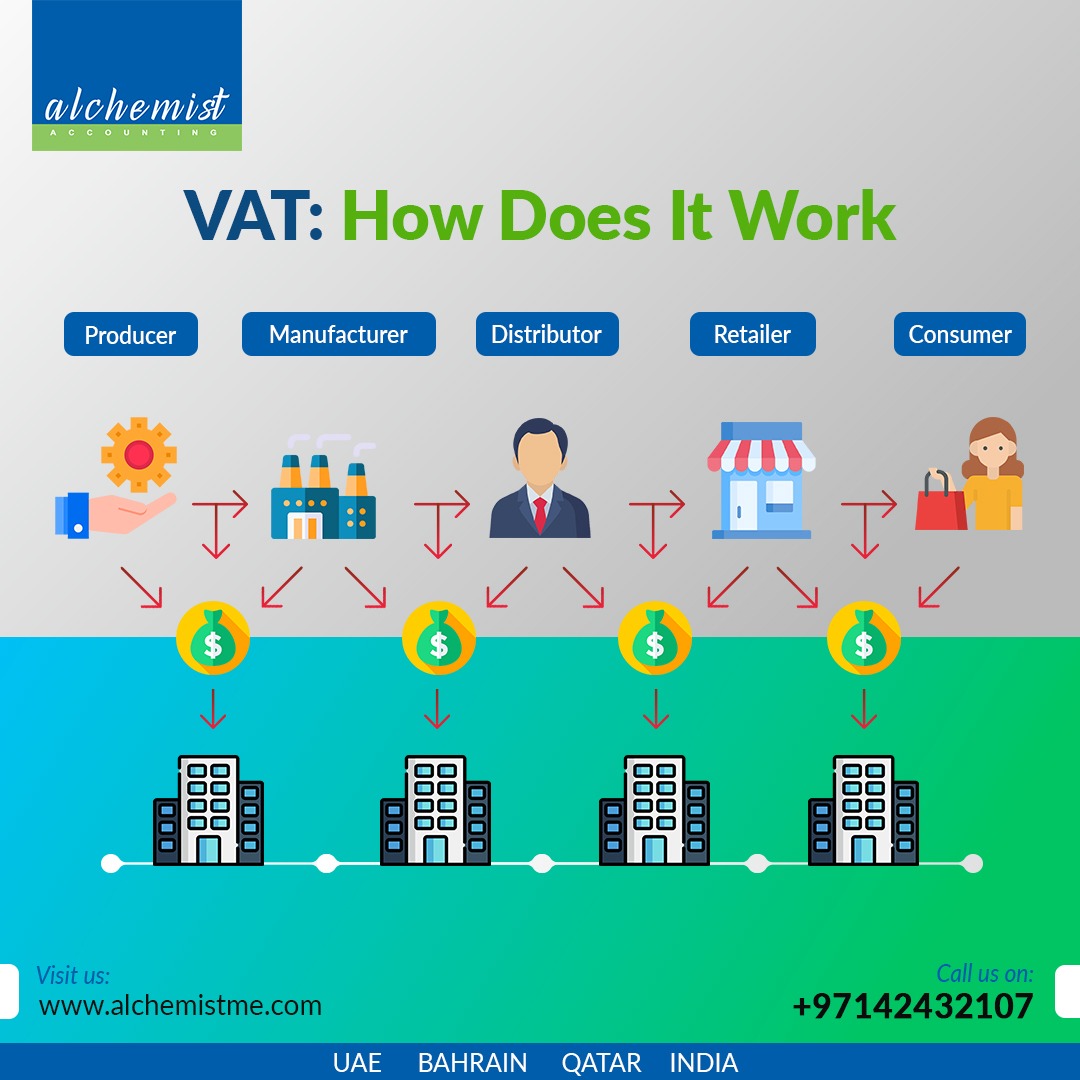

The UAE has undergone a series of tax reforms in the last few years in order to align itself with international markets and diversify its revenue, starting with the introduction of Value Added Tax (VAT) in January 2018, followed by the introduction of ESRs in April 2019 and Country-by-Country Reporting (CbCR) regulations in April 2019. On 31 January 2022, the tax landscape shifted once again. The Ministry of Finance (MoF) of the United Arab Emirates (UAE) announced that a new federal corporate tax (CT) system would be implemented in the UAE with financial years starting on or after 1 June 2023. The UAE introduced a standard 9% corporate income tax rate, which is the lowest within the GCC region, barring Bahrain.

A certain level of complexity exists in the UAE corporate tax regime, which is unavoidable, in a diversified economy like the UAE. However, the UAE government has taken steps to keep the UAE corporate tax regime as simple as possible, which may help businesses reduce compliance costs. Herewith, the UAE corporate tax regime will provide relief for small businesses by simplifying financial and tax reporting duties. Providing small business relief is important since tax compliance is disproportionately burdensome for small and medium-sized businesses worldwide.

How to calculate the payable corporate tax?

Businesses should be aware of the various segments of corporate tax to determine the tax amount they are liable to pay to the government. In order to determine the amount of tax payable, the following factors must be considered:

- The UAE levies on the annual taxable income of a business

- The corporate tax amount will be 0% for taxable income not exceeding AED 375,000 and 9% for taxable income exceeding AED 375,000

- Calculation of taxable income should be based on the accounting net profit (or loss) in the financial statement

In a nutshell, corporate tax is calculated at 9% of the net profit shown in the financial statements of the business and is determined after all applicable deductions. Any foreign taxes paid will also be entitled to a reduction from the profit shown in the financial statement. The net profit derived after all deductions are viewed as taxable income.

Dividend income earned by UAE Company from its qualifying shareholdings (to be defined in the law), capital gains, profits from group reorganization and intra-group transactions shall be in general exempt from Income Tax. Domestic and cross-border payments will not be subject to UAE withholding tax.

Foreign Tax Credits

Corporate tax in the UAE applies to the worldwide income of UAE resident companies including income from foreign sources that may have previously been taxed by a government in a manner similar to corporate tax in the UAE. In order to prevent double taxation, taxes paid in a foreign jurisdiction will be credited against UAE corporate tax liabilities on foreign-sourced income that has not been otherwise exempted. It is referred to as the "Foreign Tax Credit".

Why get it done with an expert?

Most firms in the UAE end up calculating taxes in hassle finding it difficult to put aside the time to do this. Remember, it takes a bit of time and effort to ensure that your corporate tax is calculated precisely. As it is a complex procedure that is needed to be done without any mistakes, it can’t be done hastily. Yes, it is way more than crunching numbers! Hiring a professional tax consultant will get the work done efficiently, thereby giving you the time to focus on your business.

If you are struggling with calculating your tax in the hustle and bustle of your daily business, and are on the lookout for a tax advisor in the UAE, Alchemist is a name you can trust. Alchemist, with more than 5 years in the business with over 1,000 clients across GCC, has expert teams of Chartered Accountants, and Management Accountants who can help you with every financial aspect of the business, including but not limited to tax consultancy services, audit & assurance, outsourced accounting, ERP consulting, and bookkeeping. Being one of the best auditing firms in the UAE, Alchemist offers all the financial advice and services, tailored to suit your business needs.

Be it calculating corporate tax or filing your taxes, getting it done with a professional touch will not only ensure corporate tax compliance but will also help you to prevent relevant penalties, thereby assuring efficiency in your business. It doesn't matter whether you run a start-up or a multinational company, Alchemist offers personalized and tailored financial services to suit your needs thereby helping you to pay tax efficiently without hassle.

Recent Blogs

-

UAE VAT :B2B Medical services -Public clarification

VAT Public Clarification Business-to-Business Supplies of Healthcare Services Issue Depending on the circumstances

-

Tally ERP - Simple & Powerful

Tally is MENA's leading business management software solution, which today enables more than 2 million businesses worldwide.

-

Bahrain VAT : Impact on Construction Industry

With introduction to Value Added Tax (VAT) regime in Bahrain, now attention is turning to those industries where it has major impacts and posing serious challenges. Of particular interest is the construction sector in Bahrain.

-

Economic Substance Regulation (ESR) in UAE

The United Arab Emirates (UAE) released the Cabinet of Ministers Resolution n. 31/2019 with effect from 30 April 2019, concerning the Regulations for Economic Substance (ES) in the UAE. The introduction of the new ES rules is a milestone for the UAE’s tax policy towards its alignment with the global Organization for Economic Co-operation and Development’s(OECD) Base Erosion and Profit Shifting (BEPS) directives.

-

How to Avoid Looking Silly When Asked About Tally ERP

Detailed information about Tally ERP and every aspect related to it. Grow your business by keeping up to date with latest technologies.

-

Discover the Secrets Behind Setting up a Small Business in UAE

Opportunities and Provisions provided by UAE for setting up small businesses within a span of 8 days through 6 simple procedures.

-

See How Easily You Can Outsource Accounting Services in UAE

With our business accounting services, you will get experienced skill set. Accounting Services can help you with the new accounting trends.

-

The Ultimate Guide to Free Zone Company Setup

Dubai is a major attraction for emerging businesses because of its incredibly lucrative business landscape. Here is your ultimate guide to free zone company setup in Dubai.

-

5 Little Known Ways to use Zoho CRM

Zoho CRM helps your business to interact with customers and increase their revenue. It can help you in automating of your sales process.

-

The Unfortunate Truth about VAT consulting

VAT is a tax on the use of services and goods at each point of scale. outsourcing accounting services is better for the businesses which are not equipped with adequate resources to support VAT implementation.

-

What Your Competitors Wish They Knew About Outsourced Bookkeeping and Zoho Books

With the availability of software like Zoho books, bookkeeping can be maintained and managed in an effective manner. We will share with you everything you need to know about outsourcing bookkeeping and Zoho books.

-

7 Reasons for Outsourcing Finance

Finance and accounting are critical to business operations. If you still have second thoughts about outsourcing finance, here are seven reasons why you should choose to outsource finance for the better of your business.

-

5 Reasons why Outsourcing Finance is important

Here are five reasons why outsourcing finance is extremely important for any organization. Contact us to know about the benefits of outsourcing finance.

-

Here's what you didn't know about Outsourced Bookkeeping Services

Here’s what you did not know about outsourced bookkeeping services. To know about the bets options of outsourced bookkeeping services, contact us.

-

Few difficult questions answered about Tally ERP

Contact us to know more about Tally ERP. Here are a few difficult questions answered about it.

-

The Secret to Zoho CRM is revealed

Zoho CRM is an extremely low-cost CRM that suits the needs of all businesses. To know more about it, contact us.

-

5 Valuable lessons from VAT consultancy services

Here are Valuable lessons from VAT consultancy services. To know more about VAT implementation in GCC, contact us.

-

The Ultimate Guide to Zoho Books

Zoho Books is an innovative and intuitive software that streamlines all back office duties to manage an organisation’s finances and cash flow, and track its expenses.

-

Top VAT Consulting Services and Their Challenges in 2020 and Beyond

Value Added Tax or VAT is often considered to cost less for businesses. This statement is true for some but in most cases where a business is changing and managing new obligations, VAT can get a little confusing.

-

Tips for setting up a small business in UAE successfully

If you are planning on setting up a small business in UAE, start while you are still earning – don’t quit your day job just yet.

-

Advantages of Outsourced Bookkeeping and Accounting Services

Outsourced bookkeeping services and firms need to constantly keep their skills and qualifications updated to stay relevant and competitive in the market.

-

A Helpful Guide to Inventory Management and Tally ERP

From small to large, companies have been using ERP systems to manage their business operations. So what is Tally ERP and what are its uses and functions that you can apply to your business?

-

An Intro to Free Zone Company Setup in the UAE

The basic steps and pointers to keep in mind before setting up a business are to make sure that you determine the type of legal entity your business would be affiliated.

-

Choosing the Right VAT Consulting Services

We can witness a rapid growth of VAT consulting services in the UAE, which can make it both easier and harder to choose a good organization that provides all the services that you would require for the smooth functioning of your finances.

-

How Zoho CRM Can Help You Align Your Business

Zoho CRM is highly versatile and allows the company the opportunity to build the interface according to their own needs.

-

How to Configure VAT advisor with Tally ERP

Tally ERP is a software that is equipped all the features required to be fully functional for the computation of VAT.

-

How Outsourced Accounting and Bookkeeping Can Increase the Efficiency of a Business

Outsourced accounting and bookkeeping services ensure that the company’s book account books are always updated and ready to be used for tax filing. Moreover, the book of accounts also helps understand how the tax returns can be acquired.

-

How VAT Consultants in Bahrain Can Help You With VAT Implementation in Your Business

VAT consultants in Bahrain can also help with highlighting any potential issues they think might come up related to taxes and non-compliance and keep the businesses on track. Once all issues are taken care of as per the Bahrain VAT Regulations, VAT Returns can be filed by the firms.

-

Is Choosing Outsourced Finance and VAT Consulting Services a Right Decision?

For start-ups, small, and medium sized companies outsourcing their finances, accounting and VAT Consulting Services through an experienced and qualified business partner is the best way to guarantee expertise at the lower rate than through in-house recruitment.

-

Importance of Choosing an Accounting Consulting Firm in UAE

If it feels like keeping an in-house accounting department is a resource that you can fully utilise or afford, there are many accounting consulting firms in UAE that can be of assistance to you at a lower cost and at recurring intervals.

-

VAT on Medical Services in the UAE: Some Insights

Even after the zero-rate VAT on medical services, it is critical for companies to make use of the relevant technology and manage its tax compliances.

-

How Zoho Expense Can Help Manage Accounts and Finance

Through the Zoho Expense app, the users can capture receipts and email them to each user through their unique user IDs, synchronised with corporate or personal credit cards.

-

Best Practices and Secret to Zoho CRM

All Zoho apps, including Zoho CRM can be accessed across all devices and almost all operating systems, browsers, and mobile devices. Since Zoho has data centres across continents, including the US, Europe and Asia, the organisations can choose their data centre in their preferred location.

-

Advantages of Using Accounting and Bookkeeping Services in Bahrain

Accounting and bookkeeping are two very integral processes in business strategy. Since businesses and enterprises have been continuously increasing in Bahrain over the years, the need for accounting and bookkeeping services in Bahrain has also seen a rise.

-

Advantages of Using a Zoho Books Consultant for your Company Processes

Implementation for Zoho Books consultants is the process documentation. After the process analysis is done, the consultants need to finalise and document the approach they have decided upon for the company.

-

Using Auditing Firms in Qatar to Simplify Your Business

There are a lot of auditing firms in Qatar with qualified and experienced auditors so companies have a lot of choice when it comes to choosing one for them.

-

How Accounting and Consulting Firms in UAE assist with VAT Services in Free Zone Company Setup

Accounting and consulting firms provide quality VAT services to free zone companies in Dubai and the UAE. Businesses within the Free Zones also have similar rules regarding VAT as they are for the other non-designated areas

-

What Services do VAT Consulting in Dubai and UAE Involve & How They Can Help You

Since VAT came into effect in 2018, a wide range of companies and enterprises have been looking for specialised services that VAT advisors and VAT consulting services can provide them. Monthly, yearly, or half-yearly audits have now become a must for all businesses in the UAE.

-

Integrating Outsourced Bookkeeping & Zoho Books in Your Business

In this article we will discuss the advantages of integrating outsourced bookkeeping and Zoho Books on your business for an easy outsourced finance system.

-

Implications of VAT on Medical Services in the UAE

However this entitlement to apply the 0% rate of VAT on medical supplies and services is subject to strict conditions and rules.

-

Why Hiring Accounting Consulting Firms in Dubai is the Right Decision

Hiring accounting consulting firms in Dubai can assist businesses in making financial decisions visibly and independently.

-

How Accounting and Consulting Firm in UAE Can Assist in Free Zone Company Setup

This is where experts from accounting and consulting firms in UAE can be helpful. Freedom in the operations of the business, huge margins in tax savings, and many favourable government policies make investors and businessmen set up their operations in Dubai’s free zones.

-

Advantages of Hiring VAT Consultants in Bahrain

There are many advantageous reasons as to why a company should hire VAT advisors or take help of VAT consultants in Bahrain.

-

Tips to Configure VAT & Reduce Penalties After Setting up a Company in UAE

VAT penalties in UAE can be imposed for various reasons and can have far-reaching consequences when one is setting up small business.

-

Adding Value to Business through Auditing Firms in Qatar

Auditing firms in Qatar consist of a lot of experienced and certified professionals. All the auditors are responsible to perform a task that is related to accounts and finance.

-

Accounting and Consulting Firm in UAE Save Cost Post-COVID 19 Through Outsourced Finance

Outsourcing through accounting and consulting firm in UAE is a growing phenomenon with numerous advantages.

-

Business Growth Strategies and Tips for Accounting Companies in Bahrain

Accounting companies in Bahrain can easily improve their processes and escalate their growth by following some growth strategies.

-

Company Requirements for Auditing Firms in Qatar

When choosing an auditing firm in Qatar for their business, some essentials to keep on mind are that firstly the firm must be registered under the State of Qatar.

-

Using Zoho Books Consultant to Integrate Outsourced Bookkeeping Processes

Integrating outsourced bookkeeping and Zoho Books on the business allows for an easy outsourced finance system.

-

Using an Accounting and Consulting Firm in UAE to assist with Mergers & Acquisitions

Accounting and consulting firms in Dubai provide audit and specialised consulting to its valued clients to improve their efficiency so that they thrive in the competitive environment.

-

Benefits of a Third-Party Accounting & Consulting Firm in UAE for Business Performance Review

Usually accounting and consulting firms in UAE have well trained teams specialized in business performance review and preparing reports that give a clear idea of the company’s profitability, liquidity and efficiency.

-

Basic Analysis of the VAT Framework and How VAT Consultants in Bahrain Can Help

VAT consultants in Bahrain can help smoother out the steps needed for businesses to configure VAT easily.

-

Some Brief Observations by VAT Consultants in Bahrain on the Healthcare Sector

Key decision makers in the UAE, Saudi Arabia and Bahrain need to ensure their processes and systems are - and remain - VAT-compliant, and in such instances, the guidance of VAT consultants in Bahrain can be of a lot of help.

-

Why Select an Auditing Firm in Qatar for Your Business

Most auditing firms in Qatar provide a thorough, in-depth audit with an impartial look at the organisation’s internal systems and controls.

-

How an Accounting and Consulting Firm in UAE can Help with Setting up a Small Business

Most accounting and consulting firms in UAE are affiliated with major Free Zones as authorized agents and it can offer a new company lot of advantages to be associated with them.

-

How Accounting and Consulting Firm in UAE Help With Free Zone Company Setup

Partnering with an accounting and consulting Firm in UAE can help simplify and accelerate these processes for a new business entity.

-

Factors You Should Consider When Investing

Factors one should consider when they are investing.

-

A Step-by-Step Guide of Outsourcing Finance

Outsourcing service is never easy. It requires a good amount of research to trust another company to handle this for you. We have a step-by-step guide on How you can easily outsource your finance process to another company.

-

Industries that VAT will have the best impact on

VAT (Value added Tax) has changed over time and it’s upon us all to start looking in detail at the potential impacts it will have on businesses.

-

VAT consultants’ key insight to the VAT framework – what you need to know

VAT framework includes different taxation and management regulatory strategies. It should be structured in a manner that is beneficial for the corporation's overall business and VAT consultants play a very important role in drafting it right.

-

Zoho Office Suite – a brief synopsis of the software and its benefits

Zoho is a really effective software for all your business needs. It's simple yet effective functionality and cost saving features serves businesses a great all in one solution.

-

Choosing the most rewarding accounting schemes for your company

Choosing the right accounting scheme becomes really important as it serves your business taxation process and helps you save more in the long run.

-

New taxation and accounting norms 2021

For the advancement of economies, new norms and regulations are passed in terms of taxation and accounting. Companies need to be updated with these norms in order to avoid challenges

-

Cash flow management with proper accounting techniques

The cash flow management process is very beneficial for companies and upgrading the accounting techniques will help you a lot better.

-

How to conduct auditing process in 2021

With VAT norms and structured taxation laws in 2021. It's important to understand the depth of conducting an audit process.

-

Right way to ERP implementation process

ERP implementation process is a simple process and needs to be managed properly with the right set of people and resources.

-

Taxation in 2021- A brief explanation

Taxation in the UAE after the introduction of VAT has changed in the last couple of years. UAE is a powerful economy and has various taxation norms.

-

More about Zoho Bookkeeping records

Zoho books help in accounting and Bookkeeping that deals with a lot of companies' internal and client's data of transactions and accounts.

-

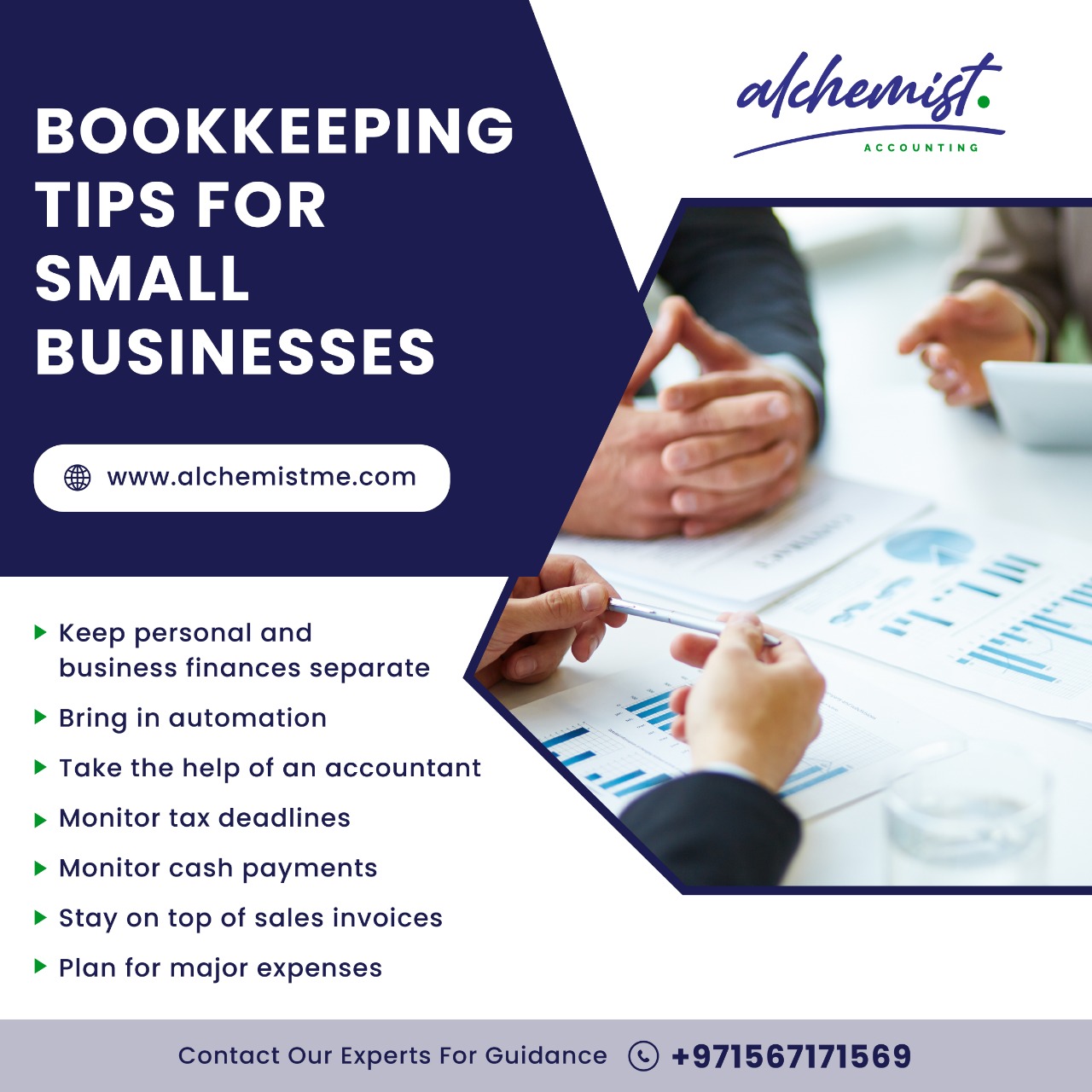

Common Bookkeeping mistakes to avoid in 2021

Bookkeeping and accounting are two very important aspects of the business. To do bookkeeping in the right manner is important.

-

How financial advisory firm help your firm save on taxes

Financial advisory firms like Alchemist are focused on providing the best taxation strategy to their clients and help them attain the right profits.

-

Challenges while implementing VAT

VAT filling is a time-consuming process. It needs proper implementation planning and strategy to execute.

-

Improve cash flow when facing insolvency

Cash flow is an important aspect of a company and when the company is facing challenges it becomes difficult to cope up.

-

How auditing firms in UAE can help you grow your business

Accounting is an important part of controlling the financial situation of any organization at any given time. In addition, it supports management decision-making.

-

How VAT Consultants in Bahrain can guide you for VAT registration in 2021

Bahrain tax norms are different and VAT registration needs proper attention.

-

How auditing firm can help you do necessary business audits in UAE?

Auditing firms have highly skilled and qualified consultants who make the auditing and accounting work very easy for business organizations.

-

How expert ERP consultant in UAE can help your firm towards business growth.

ERP implementation is a very challenging and time-consuming process. Firms are sometimes unable to structure the right approach for this that's where the right ERP consultants can help.

-

New methods to outsource bookkeeping services in UAE

Every business combines a variety of outsourced accounting and bookkeeping procedures to generate accurate and objective information that serves as the basis for decision-making.

-

How Zoho Books Can Make Bookkeeping Easy?

Zoho brings the most advanced time management tool ever made to task while eliminating the time taken from day-to-day tasks and making them manageable.

-

Benefits of doing Business in Bahrain

Bahrain is a powerhouse of business opportunities, especially for those who have been outside the Gulf. The positive outlook for business growth and expansion in Bahrain is based on a wide range of factors, including an educated workforce, flexible labor markets, a well-developed property market, and a competitive business environment.

-

UAE Tax Procedure-Voluntary Disclosure

The voluntary Disclosure system provides citizens with information about their rights and duties under the law, and it helps them to be aware of the procedures required for filing a complaint or taking legal action in case of tax filing issues.

-

Accounting process during company mergers

Accounting is the most essential function performed by almost every company. Without an accurate and complete understanding of your business, it is difficult to plan, coordinate, and execute projects on time and within budget

-

Effective Financial Strategies for you business in UAE

Effective and efficient business strategies are different for each type of business. For example, an efficient small business owner will likely outsource some tasks, while an efficient business owner will use technology to cut down your expenses.

-

Different type of Financial statement analysis in 2021

When most people think of auditing their financial statements, they tend to think about absolute comparisons. For example, they might think of comparing their income statement from one year to the next to see whether their total income has increased or decreased.

-

5 step methods to obtain audit evidence in UAE

The audit technique is one way of gaining insights through conversation - especially if you are being interviewed by someone .

-

How to Find Best Bookkepping firm in Dubai

The best bookkeeping firms are the ones that are able to provide you with all kinds of accounting services and help you reduce the costs involved in keeping track of your finances. But before you decide on one.

-

Importance of having a company setup in free zone of UAE.

When you think of free zones,The idea behind free zones is to provide entrepreneurs with an opportunity to grow without any restrictions. These zones are provided free of cost or at a reduced price

-

Merger and Acquisition:Why should management should restructure the business after M&A?

M&A deals have become more common in recent years as companies look to expand their business and secure new sources of revenue. But how do you determine which deal will be worthwhile? How do you know when it's time to move forward with a deal?

-

Measures to avoid blunders while doing Internal audit

An internal audit covers the whole business operation from top to bottom. The objective is to draw conclusions which make an organization more solid and efficient in carrying out its tasks. The outcome can be improvement in terms of efficiency and trustworthiness or loss of some specified information. To make sure that all parts of an organization are operating at optimum efficiency, a thorough internal audit should be undertaken on a regular basis

-

Why VAT health check is important?

A business needs to be compliant with all applicable taxes and duties in the countries where it operates. UAE laws surrounding business licenses, fees, taxes, government assistance programs, and special tax treatments may require businesses to obtain additional documentation such as copies of invoices and tax invoices to fill the VAT.

-

Factors to consider while switching Bookkeepers

Bookkeeping is a significant part of the business, whether you’re a sole proprietor, partner or employee. You need to ensure that ethical, reliable and has the necessary expertise is installed on your team. Just like any other job, bookkeeping requires discipline and a commitment from the individual.

-

Company formation in UAE demands approved Auditors

An auditor is one who examines companies for compliance with laws and regulations. He or she examines account statements, budgets, income statements, balance sheets, etc., makes recommendations to corporate management, and issues reports on findings.

-

Factors Influencing the Cost of Accounting Services in UAE

Picking the best accounting services in the UAE will not only be profitable but economical as well. If you are contemplating appointing professional accounting services in the UAE, then here is a clear idea of the budget.

-

Key Role & Responsibilities of Internal Auditors UAE

Here we describe the roles and responsibilities for internal audit and compliance within an organization in UAE

-

List of Accounting Qualifications to Boost Your Career in UAE

If you think accounting is the career for you, here are some accounting qualifications to boost your career in UAE

-

Best Accounting Software for Your Business in UAE

Finding the best accounting software's for your business in the UAE is now faster and easier! Call us for the best online accounting software and download the Zoho Books

-

New VAT Fines and Penalties in UAE

Let us discuss these violations and their respective administrative penalties under VAT in UAE.

-

How to set up accounting & bookkeeping service firm in the UAE

No doubt you have plenty of questions about how to set up a new accounting & bookkeeping firm in the UAE. Alchemist Accounting provides a full range of computerized financial accounting & bookkeeping services for company in UAE.

-

MOF UAE to introduce federal corporate tax from June 2023 - Key Features

The UAE MOF will introduce a federal Corporate Tax on business profits effective for financial years starting on or after 1 June 2023.

-

Common errors made by the firms while filing VAT returns in UAE

What is VAT return filing? Every VAT registered business or individual in UAE need to file VAT returns. Alchemist Accounting offers VAT return filing services in Dubai, UAE

-

Vat Deregistration in the UAE What You Should Know

Fulfil all the criteria to deregister for VAT in UAE with Alchemist Accounting.

-

Your Guide To A Successful Financial Audit UAE

Your business may be obliged to present audited financial accounts. Alchemist Accounting gives you all the information you need.

-

Excise Tax UAE and Its New Amendments

Do you have questions about tax in UAE? Alchemist Accounting & Consulting provide accurate answers to questions on Excise Tax registration and amendment forms

-

VAT Health Check Services in UAE - Identify the Errors

VAT Health Check is importance for your business to ensure that it complies with the legal requirements of the VAT in the UAE

-

How to select the best chartered accountant firm in Dubai UAE

The best-chartered accounting firm in UAE has been offering its services to a wide range of companies & individuals for many years. The following are a few of the ways to find the top chartered accountants in Dubai.

-

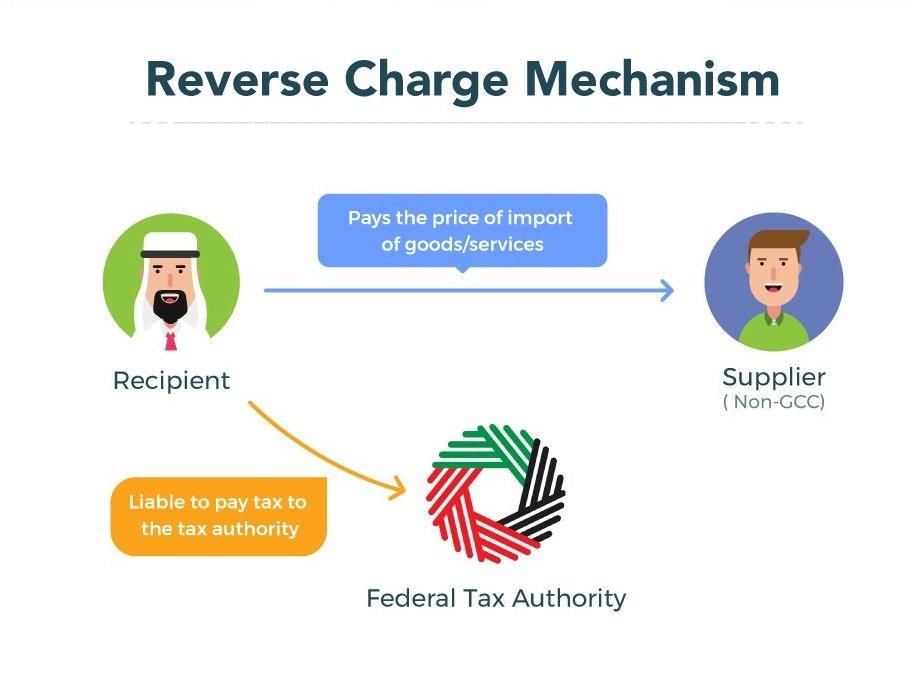

VAT Reverse Charge Mechanism & Application In UAE, Bahrain, Oman & KSA

What is the VAT reverse charge mechanism in the UAE, the KSA, Oman, and Bahrain, and how does it work in the practice?

-

How to Adjust the Value for VAT in Oman

Learn about VAT within Oman, implemented April 2021. Get free VAT consultation in Oman, Qatar from Alchemist Consulting experts

-

Don't skip yearly external audits in Dubai, UAE - Here's Why

External audit in Dubai, UAE involves a routine checking of company records & procedures. External auditing Services in Dubai, offered by Alchemist accounting with registered auditors in UAE ensure the financial records of a business firm.

-

Accounting Terms & Concepts Every Entrepreneur in Dubai Must Know

Your company needs to be familiar with some basic accounting terms and concepts to run your business successfully in Dubai, UAE.

-

Corporate tax & Its Guidelines In UAE - Federal Corporate Tax

Stay compliant with UAE Tax Laws and Regulations.

-

How to Check If Your Business Falls Within the Scope of UAE Corporate Tax?

Alchemist Accounting is one of the top competent corporate tax consultants for investors in Dubai.

-

Best Corporate Tax Consultants in Dubai, UAE

You should hire corporate tax consultant businesses in Dubai for a major impact on your business.

-

Exempted Entities Under the UAE Corporate Tax

We can provide you with advice on important corporate tax rules, including the creation of tax groups, how tax losses are handled, tax exemptions, the tax liabilities of free zone firms, etc

-

Are free zone companies exempt from corporate tax in the UAE?

Alchemist Accounting is one of the top accounting firms in UAE, providing tax advisory support and consulting to businesses that want to or are already doing business in the mainland UAE and the Free Zones. For more information, feel free to contact us.

-

Guide to E-commerce Accounting in the UAE

A qualified professional accountant in the UAE can assist the e-commerce venture in future planning by analyzing its growth. A

-

How Accounting Firms in the UAE Can Help You Save Money

Alchemist Accounting experts can help organizations in finalizing the books of accounts on periodic basis, training and supervision of accounting team and to setup a continuous monitoring system.

-

Why Is It Important for UAE Companies to Maintain Books of Account & Audits?

The audit services we offered by Alchemist can help you to get a clear understanding of your business transactions and access an accurate risk assessment report, giving you a better understanding of your business's risks and building a better reputation for your company.

-

What is Zoho and How Can It Help You Manage Your Finances?

Zoho is a powerful financial management tool that makes it easy to track your expenses, automate payroll, manage invoices, and more. Get started with Zoho today and take control of your finances with this all-in-one solution.

-

How to Prepare for Corporate Tax

Getting ready for corporate tax doesn't have to be complicated. Learn the basics of corporate tax preparation with our step-by-step guide. We'll show you how to organize your documents, calculate deductions, and submit your return accurately and on time.

-

Small Business Relief for UAE Corporate Tax

Alchemist Accounting is well equipped with a team of experts who can best assist in your corporate tax and accounting needs. We are guided by the principles of trust and efficiency and will provide you with the excellent service that you deserve. To get a free consultation reach out at +971582660929 and talk to our experts.

-

Corporate Tax: Categories of taxable persons who require a financial audit

Alchemist Accounting is here to best assist you in the coming accounting regime and prepare your business for it. Need to know more about corporate tax and the accounting preparations needed for corporate tax in UAE? Reach out to us at +971582660929 to learn more about the new updates.

-

Understanding UAE VAT How to Maintain Accurate Accounts and Records

Alchemist accounting comes in, we have a team of experienced accountants and auditors who will use the latest technological solution from Zoho, Odoo etc and make sure that your business in VAT ready. For more details, contact +971582660929 and our experts will be in contact with you.

-

UAE Corporate Tax Registration for private firms starts today

Alchemist Accounting is here to help you sail through the corporate tax guidelines and ensure that your business computes corporate tax during the financial years. To get a detailed idea of corporate tax and how to prepare for it, reach out to us at +971582660929 and get a consultation with us.

-

Economic substance Regulations

Alchemist Accounting can provide all-round services related to accounting and financial planning. Talk to our consultants by calling us at +971582660929.

-

Unveiling the Top 5 Benefits of Outsourcing Your Accounting Needs

Alchemist Accounting is the expertise you would want for your business, with a team of professional we can provide all the accounting services required by a business. Reach out to us at +971582660929 to know more

-

Bank-Approved Auditors In UAE Everything You Need To Know

Need bank-approved auditors in UAE? Alchemist offers a comprehensive list of reliable auditors who can help you meet your financial goals. Our team of experts provides expert advice and guidance to ensure that all audits are accurate and compliant. Get started today and

-

What Is The Future Of Digital Banking In The UAE

The financial industry in the United Arab Emirates (UAE) has been constantly evolving and changing to bring benefits to the people and the UAE government. The latest and most important trend is the extensive use of technology for banking and other financial needs. As mobile apps and non-banking entities enter the market, traditional banks are compelled to adapt swiftly to remain competitive.

-

2 new decisions on corporate tax regime in free zones

Discover the latest updates on corporate tax regulations in free zones. Stay informed and make well-informed business decisions with our comprehensive analysis of the two new developments in the corporate tax regime. Maximize your tax benefits and optimize your operations today.

-

4 Benefits of Hiring a Bookkeeper to Streamline Your Business Finances

Alchemist Accounting and get the complete solution for your bookkeeping needs and enjoy the benefits of having a proper financial management system. Give us a call at +971582660929 to start today with your bookkeeping needs.

-

Get Up to Speed with UAE's New Tax Residency Guidelines An Overview and Overview of What It Means for Businesses

Stay ahead of the game and navigate the new tax residency guidelines with ease. Our comprehensive overview breaks down what these changes mean for businesses. Gain a clear understanding of the implications and make informed decisions to optimize your tax strategy. Don't let these new guidelines catch you off guard - be prepared and stay compliant.

-

A Comprehensive Guide to Understanding IFRS, its Requirements, Role and Benefits

Discover the world of IFRS with our comprehensive guide. Understand the requirements, role, and benefits of International Financial Reporting Standards. Stay ahead of the game with expert insights and practical advice. Start navigating the complexities of IFRS today!

-

Introduction to Digital Banking in UAE and its Potential

Discover the potential of digital banking in the UAE with Alchemist. Streamline your financial transactions, access convenient banking services, and stay ahead in the digital age. Explore our innovative solutions and unlock limitless possibilities for a seamless and secure banking experience.

-

5 Ways an Accounting Company in Dubai Can Help Your Business Take Off

Discover the top 5 ways an accounting company in Dubai, like Alchemist, can revolutionize your business. From expert financial analysis to strategic tax planning, our team of professionals is here to optimize your financial success. Trust Alchemist for reliable accounting services tailored to your specific needs.

-

Financial Records Required for Corporate Tax Registration and Filing Returns

The UAE government in its effort to raise the standards of economy to global standards has introduced corporate tax and the economic landscape of the country is about to undergo several changes. As businesses in UAE understand and adapt to this new tax regime, it is crucial for them to understand the documents and financial records required for corporate tax registration and filing returns.

-

Determination Of The Corporate Tax Period And Its Deadline For Submission

Corporate tax has been introduced in the UAE economic landscape, and it is crucial for any business operating in the UAE to have a good idea about the procedures related to corporate tax. Today, we're delving into one of those crucial subjects: the corporate tax period and the all-important deadlines for submission.

-

The Importance of Accounting for Small Businesses in Dubai

The success of any business is determined by the way they deal with their finances and plan ahead for the future. That is where accounting comes in. There are many accounting firms in Dubai, and the reason why a small business should hire an accounting firm is because, with a proper accounting system, any business can thrive in the economic landscape of Dubai.

-

Accounting Services for Your Private Firm in Bahrain

Looking for reliable accounting services for your private firm in Bahrain? Look no further! Our experienced team of accounting professionals is here to provide you with top-notch financial solutions tailored to meet the unique needs of your business. Streamline your financial processes and gain peace of mind knowing that your accounts are in good hands. Contact us today for a free consultation.

-

Seven Steps for Creating a Robust Financial Plan for Businesses in 2024

Any business’ success can be defined by the way they handle the accounting, the same goes for business in Dubai and as well as how they create the financial plan of the business. Hence it is important to follow the right plan when setting up the financial plan for your business in 2024; you can get the help of an accounting firm in Dubai like Alchemist who uses smart tools like Zoho or Odoo with us. The planning includes things like finding the right key points in the year to start a project or identifying the financial needs that can come up during the year.

-

Accounting Supervision Services in Dubai UAE

Dubai has a growing economic landscape, where economic activities thrive, the need for robust financial oversight has never been more critical. One of the key elements contributing to this oversight is effective accounting. However, the complexity of financial transactions and the dynamic regulatory environment in the UAE make it imperative for businesses to go beyond traditional accounting practices. This is where Accounting Supervision Services play a pivotal role, ensuring that financial processes are not just managed but strategically supervised for optimal outcomes.

-

Accounting & Book keeping for Saudi SME’s made easier

It was during the summer of 2017, one of our clients who have companies in Dammam and Dubai asked me whether we can manage his accounting data entry and reporting for Saudi also in addition to what we do for his company in Dubai.

-

Audit requirement for Bahrain companies

Commercial companies are required to submit their audited annual reports for review and analysis in accordance with Bahrain’s commercial companies law, decree law no. 21 of 2001 and revised decree law 50 of 2014.

-

VAT Summit held at Manama, Bahrain

*Date : 28 April 2019 * Venue: Crown Plaza Hotel, Manama, Bahrain

-

Value Added Tax (VAT) – Are you ready?

Value Added Tax in UAE The much awaited Value Added Tax is just a couple of months away. Here is the 3 key elements to check readiness of your business to accept the change. Impact assessment: Every organization needs to have an impact assessment by considering the nature of business and type of industry. Even though