Blog

Common errors made by the firms while filing VAT returns in UAE

global

Value Added Tax, also known as VAT was introduced in UAE on 1st January 2018 that instructed all business firms that they need to abide by the rules and regulations of the new VAT Law. One of the main rules includes filing tax returns to the FTA (Federal Tax Authority) which is to be followed by firms registered as per the VAT Law. Hence, business firms must be wary of the filing of returns because even a small mistake can result in huge penalties and fines.

VAT return filing In UAE

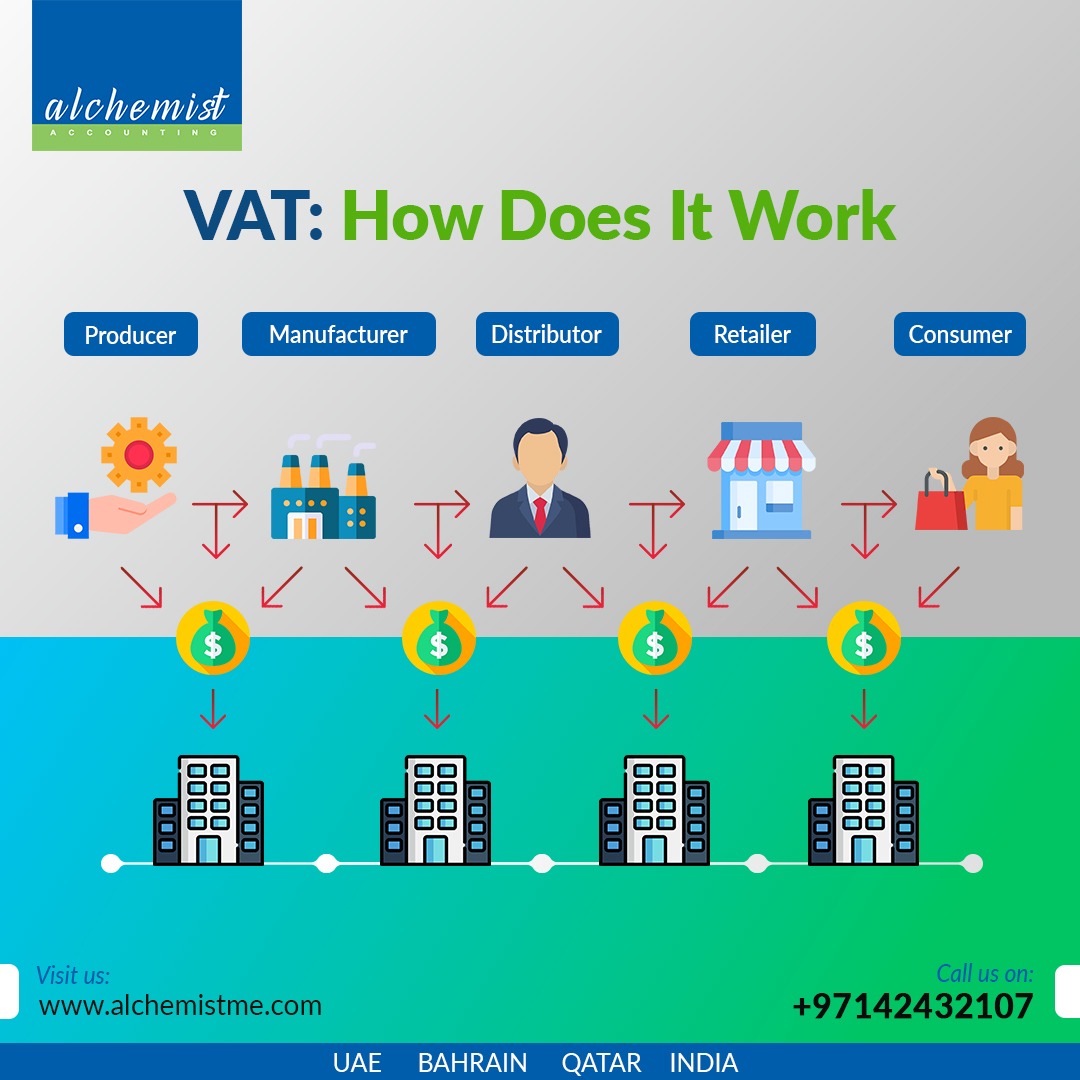

The VAT system in the United Arab Emirates is based on the consumption of goods and services. It was created to compensate for the falling revenue from the oil industry, which was re-invested in infrastructure development. The VAT-registered entities or sellers collect the VAT on behalf of the authority at the point of sale and subsequently pay the VAT to the authority within the designated time frame. The entity must file a VAT return with the Federal Tax Authority after making the payments to certify the tax payments. The following are some of the most typical errors made by registered entities while filing VAT returns:

1. Zero-rated and exempted sales are not recorded.

All firms may properly file the output and input VAT, as well as VAT payables and receivables but they could miss to record and file zero-rated and tax-exempt sales. Firms must make every effort to identify zero-rated and exempt sales, which must be appropriately reported and filed with the authority.

2. Lack of maintaining proper records.

The FTA makes it mandatory for all registered firms to maintain accurate records of every transaction in the last five years. These records can include purchase and sales records, payables and receivables, import and export records, credit and debit transactions, payroll and bonus records of the workforce, VAT and company ledgers, etc.

3. Delay and non-filing of VAT returns

The authority clearly states the deadlines for filing VAT returns during the firm's VAT registration process in the UAE. Firms must guarantee that their VAT returns are filed on time or before the deadlines. It must not cause any delays or miss the deadline for filing the VAT return. Consulting an accounting firm for guidance with VAT return filing will assist the firm in following the filing process correctly and will spare the firm from significant fines and penalties that may be imposed if the VAT return is not filed on time.

4. VAT calculation errors

When computing VAT rates, firms must ensure that they use the correct VAT rates. If the calculations are not done properly, the firm will face hefty charges in the form of fines and penalties. While performing the computations, the company must always be up to date on the current VAT rates.

5. Mistakes about reverse charge mechanism transactions

When a company imports goods and services into the UAE, it is subject to a reverse charge. It is easier to account for VAT if the tax number is linked to the customs code and reflected in the taxable person's account; nevertheless, most businesses do not link their VAT number to the portal, resulting in a variety of complications when claiming input VAT. Firms may overlook transactions that are subject to the reverse charge mechanism and mistakenly believe that certain items or services are exempt from VAT. However, since import transactions are recorded on the customs portal, firms must be cautious while registering transactions and seek advice from professionals if necessary.

6. Inadequate planning for VAT compliance

The VAT law is a fresh tax system for UAE-based firms, and it may be difficult for them to comprehend and strictly comply with it. To address this issue, businesses must develop a comprehensive strategy to ensure that they comply with the law. The firms may find it difficult to cope with the complexities. It is difficult to stay up-to-date on the various changes and legislation relating to VAT compliance. In such cases, it is always best to consult an accounting firm who are experts and have professional experienced team so that the firms may avoid big penalties and remain VAT compliant.

How can Alchemist Accounting help you?

Alchemist Accounting is always available to assist clients with their accounting, bookkeeping, VAT compliance and other fields. We have a dedicated team who ensure that its clients are never exposed to any business risks or losses. Alchemist Accounting assists by ensuring that all the vital records are available, do not miss or delay filing returns, have proper planning for VAT compliance, and assist in calculating accurate VAT returns.

As one of Dubai’s leading accounting firms, Alchemist Accounting dedicates itself to providing clients with customized services. Contact Alchemist Accounting if you have any questions.